From 6th April 2019 – Payslips for certain employees must show hours worked

As usual at the beginning of the new tax year changes will be needed to your payroll – such as uplifts to minimum wage, pension contributions and tax code changes.

This year from 6th April 2019 there is an additional change to the information that employers are required to show on their employees’ payslips if those employees are paid based on the number of hours they work.

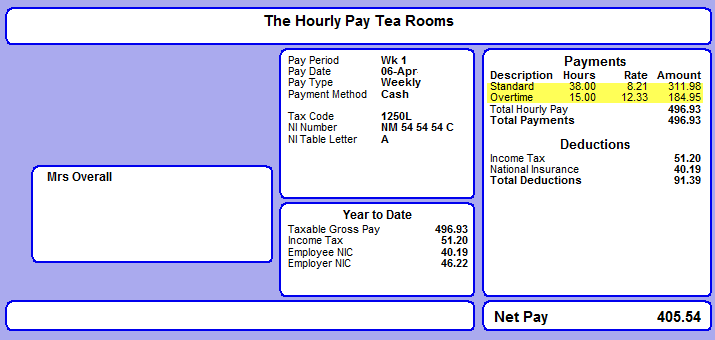

An employer will now be required to show the number of “hours worked” on a payslip if they pay staff all or an element of their pay on an hourly OR a day rate. This can be a total number of hours or differentiate between rates of pay if applicable i.e. basic and overtime rate.

So review you payroll system or talk to your payroll provider to ensure that from 6th April your payslips will be compliant with the new legislation. If you use a payroll provider then you need to make sure you are giving the provider detailed information to allow them to comply on your behalf i.e. provide the hours breakdown not just the total payable.

More information and examples can be found in the Government guidance note: “Payslips – Guidance on legislation in force from April 2019 requiring employers to include additional information on payslips”